The average ESG score for the solar energy generation industry is between 55% and 65%. Our proprietary ESG scoring framework analyzed 65 parameters across the environment, social, and corporate governance, as represented in the methodology section of this document.

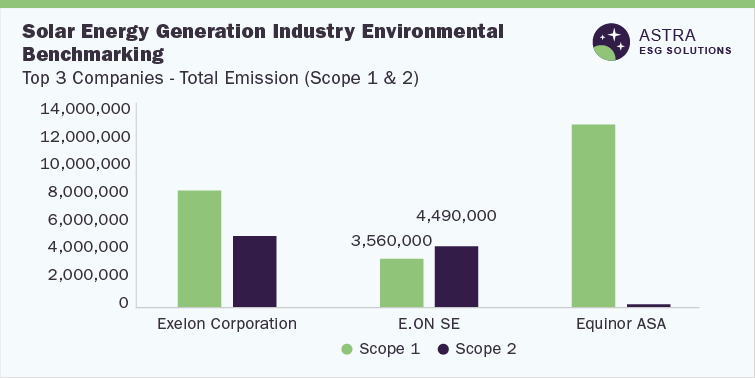

E.ON SE, Exelon Corporation, and five other market leaders were part of our research. Four of the market leaders ranked above average industry scores. However, one company needs to focus more on ESG reporting and transparency, as it scored well below the industry average. The majority of sustainability-related disclosures are centered on governance metrics, followed by environmental and social disclosures. E.ON SE leads the sector in terms of ESG disclosure, followed by Exelon Corporation and Equinor ASA.

For More Details: https://astra.grandviewresearch.com/solar-energy-generation-industry-esg-outlook

Environmental insights

Solar energy is one of the most impactful renewable energy sources that have significant potential in driving the energy transition. For example, solar panels can be used to generate clean power at home and reduce the cost of electricity in the long term. Solar panels are also a boon to the environment, as they reduce pollution. A well-built solar system within the premises can also help charge electric cars. Greater use of solar energy can, therefore, lower the need for nonrenewable fossil fuel sources, such as coal, natural gas, and so on. The use of solar power will have an immediate, measurable impact on the environment and provide a good Return on Investment (ROI).

Social insights

Solar energy generation companies have emphasized various social aspects such as turnover rate, health & safety, diversity, enterprise & employee/customer communications through surveys, and human rights alignment. These areas are essentially the foundation of a company’s social pillar. Our research found that ESG disclosure around social pillars has not been significant, and it has scope for improvement. With respect to social disclosure, E.ON SE leads the way, followed by Duke Energy Corporation and Exelon Corporation.

Our assessment showed that all major companies within the sector have conducted comprehensive employee and customer satisfaction surveys. Surveys like these provide organizations with insights into areas that need improvement. The companies have ingrained proper human rights practices within their operations along with the supply chain, and their code of conduct is aligned with global human rights standards.

Governance insights

According to our research, the average industry governance score is 71%, which is the highest among all the ESG pillars. The governance pillar included information on female board members, independent directors, compensation linked to ESG parameters, and clawback policy, among others. The industry leaders scored well above 75% in the corporate governance pillar, with Exelon Corporation scoring the highest, followed by E.ON SE and Duke Energy Corporation.

The corporate governance structure becomes robust with more independent representation on the board. Our research showed that 100% of E.ON SE's directors were Independent directors, while Exelon Corporation had the lowest percentage of independent directors. An inclusive board structure demonstrates the company's commitment to diversity as well. Exelon Corporation had the highest percentage of females on its board at 33.33% followed by the others.

Request for Free Demo: https://astra.grandviewresearch.com/solar-energy-generation-industry-esg-outlook/request/rs1